Dealing with medical bills can be a daunting and overwhelming experience, especially when faced with unexpected or chronic health issues. The financial burden of medical expenses can lead to significant stress and anxiety, affecting not only an individual's well-being but also their overall quality of life. In the United States, medical debt is a common issue, with millions of people struggling to pay their medical bills each year. According to a report by the Kaiser Family Foundation, in 2020, approximately 1 in 5 adults in the US had medical debt, with the average debt amounting to around $2,400.

The complexity of the healthcare system and the lack of transparency in medical billing practices can make it difficult for individuals to navigate and manage their medical expenses. Moreover, the high costs of healthcare services, including hospital stays, surgeries, and prescription medications, can quickly add up, leaving many people with unaffordable bills. It is essential to understand that there are resources and options available to help individuals cope with medical debt and manage their medical bills effectively.

Key Points

- Medical debt is a common issue in the US, affecting millions of people each year.

- The average medical debt amount is around $2,400, according to a Kaiser Family Foundation report.

- High healthcare costs, lack of transparency in medical billing, and complexity of the healthcare system contribute to medical debt.

- There are resources and options available to help individuals manage medical debt and navigate the healthcare system.

- Understanding medical billing and insurance claims can help individuals make informed decisions about their healthcare expenses.

Understanding Medical Billing and Insurance Claims

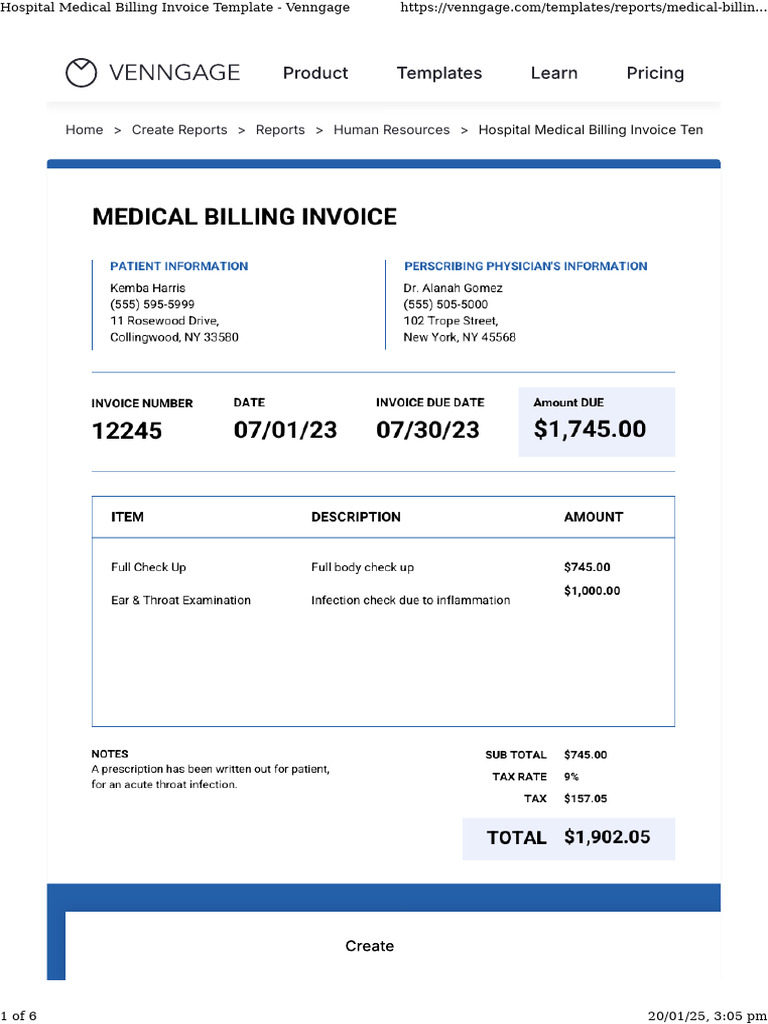

Medical billing involves the process of submitting and processing claims for healthcare services to insurance companies. The goal of medical billing is to ensure that healthcare providers receive reimbursement for the services they provide. However, the medical billing process can be complex and time-consuming, involving multiple steps and stakeholders. To navigate this process effectively, it is crucial to understand the basics of medical billing and insurance claims.

A key aspect of medical billing is understanding the different types of insurance claims, including inpatient and outpatient claims, and the various coding systems used to classify medical procedures and diagnoses. The most commonly used coding systems are the Current Procedural Terminology (CPT) and the International Classification of Diseases (ICD). Additionally, familiarity with insurance terms, such as deductibles, copays, and coinsurance, can help individuals make informed decisions about their healthcare expenses.

Types of Medical Billing

There are several types of medical billing, including institutional billing and professional billing. Institutional billing refers to the billing process for hospitals and other healthcare facilities, while professional billing involves the billing process for individual healthcare providers, such as physicians and nurse practitioners. Understanding the differences between these types of billing can help individuals navigate the medical billing process more effectively.

| Type of Billing | Description |

|---|---|

| Institutional Billing | Billing process for hospitals and other healthcare facilities |

| Professional Billing | Billing process for individual healthcare providers, such as physicians and nurse practitioners |

Managing Medical Debt

Managing medical debt requires a proactive approach, involving communication with healthcare providers, insurance companies, and bill collectors. Individuals can start by contacting their healthcare providers to discuss payment options and potential discounts. Many healthcare providers offer financial assistance programs, sliding scale fees, or charity care programs, which can help reduce medical bills.

Additionally, individuals can negotiate with insurance companies to resolve any disputes or discrepancies in their claims. It is crucial to keep detailed records of medical expenses, including bills, receipts, and correspondence with healthcare providers and insurance companies. This documentation can help individuals track their expenses and make informed decisions about their healthcare finances.

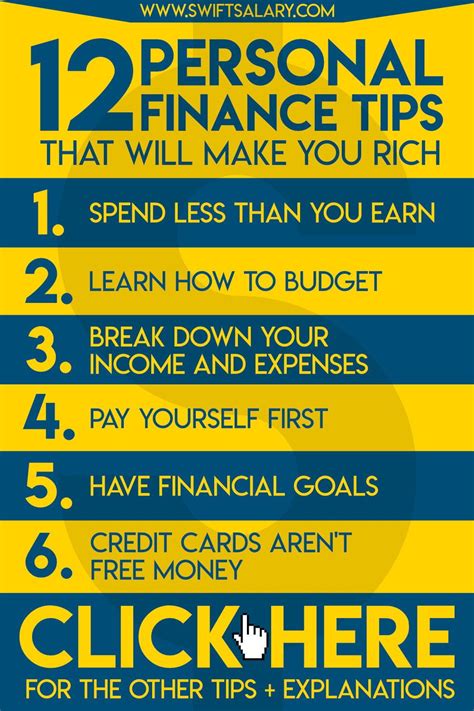

Strategies for Managing Medical Debt

Several strategies can help individuals manage medical debt, including creating a budget, prioritizing expenses, and seeking financial assistance. A budget can help individuals track their income and expenses, identify areas for cost reduction, and allocate funds for medical expenses. Prioritizing expenses involves identifying essential expenses, such as rent/mortgage, utilities, and food, and allocating funds accordingly.

Financial assistance programs, such as Medicaid, the Veterans Administration, and non-profit organizations, can provide individuals with limited financial resources with access to affordable healthcare services. Individuals can also consider seeking the help of a medical bill advocate or a patient advocate, who can assist with navigating the medical billing process and negotiating with healthcare providers and insurance companies.

What is medical billing, and how does it work?

+Medical billing involves the process of submitting and processing claims for healthcare services to insurance companies. The goal of medical billing is to ensure that healthcare providers receive reimbursement for the services they provide.

How can I manage my medical debt?

+Managing medical debt requires a proactive approach, involving communication with healthcare providers, insurance companies, and bill collectors. Individuals can start by contacting their healthcare providers to discuss payment options and potential discounts.

What are some strategies for managing medical debt?

+Several strategies can help individuals manage medical debt, including creating a budget, prioritizing expenses, and seeking financial assistance. A budget can help individuals track their income and expenses, identify areas for cost reduction, and allocate funds for medical expenses.

In conclusion, dealing with medical bills and managing medical debt requires a comprehensive approach, involving understanding of medical billing and insurance claims, communication with healthcare providers and insurance companies, and exploration of financial assistance options. By being proactive and seeking help when needed, individuals can navigate the complex healthcare system and reduce their medical debt. Remember, managing medical debt is a process that requires patience, persistence, and attention to detail.