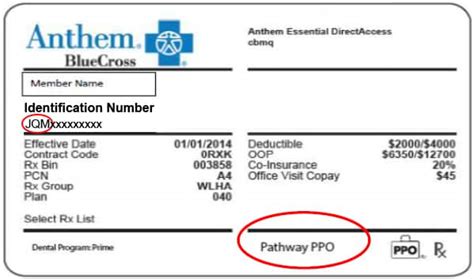

Anthem, one of the largest health insurance companies in the United States, offers a wide range of medical insurance plans to individuals, families, and employers. With a history dating back to 1944, Anthem has established itself as a trusted provider of health insurance solutions, serving over 70 million people across the country. The company's commitment to improving healthcare quality, expanding access to care, and enhancing the overall healthcare experience is reflected in its diverse portfolio of medical insurance products.

From individual and family plans to group health insurance and Medicare Advantage plans, Anthem's offerings cater to various needs and preferences. The company's health insurance plans are designed to provide comprehensive coverage, including preventive care, hospital stays, surgical procedures, and prescription medications. Additionally, Anthem's network of healthcare providers comprises over 350,000 primary care physicians and specialists, ensuring that policyholders have access to quality care when they need it.

Key Points

- Anthem offers a wide range of medical insurance plans to individuals, families, and employers.

- The company's health insurance plans provide comprehensive coverage, including preventive care, hospital stays, and prescription medications.

- Anthem's network of healthcare providers includes over 350,000 primary care physicians and specialists.

- The company is committed to improving healthcare quality, expanding access to care, and enhancing the overall healthcare experience.

- Anthem serves over 70 million people across the United States.

Types of Medical Insurance Plans Offered by Anthem

Anthem’s medical insurance plans can be broadly categorized into several types, each designed to meet specific needs and preferences. These include:

Individual and Family Plans

Anthem’s individual and family plans are designed for people who are not covered by an employer-sponsored health plan. These plans offer flexible coverage options, allowing individuals and families to choose the level of coverage that best suits their needs and budget. Anthem’s individual and family plans are available on and off the health insurance marketplace, and policyholders can choose from a range of deductible and copayment options.

Group Health Insurance Plans

Anthem’s group health insurance plans are designed for employers who want to provide comprehensive health coverage to their employees. These plans offer a range of coverage options, including medical, dental, and vision insurance, and can be tailored to meet the specific needs of each employer. Anthem’s group health insurance plans are available to businesses of all sizes, from small startups to large corporations.

Medicare Advantage Plans

Anthem’s Medicare Advantage plans are designed for people who are eligible for Medicare, including those who are 65 or older, have a disability, or have end-stage renal disease. These plans offer comprehensive coverage, including medical, hospital, and prescription drug coverage, and may also include additional benefits such as dental, vision, and hearing coverage.

| Plan Type | Key Features |

|---|---|

| Individual and Family Plans | Flexible coverage options, deductible and copayment choices |

| Group Health Insurance Plans | Comprehensive coverage options, including medical, dental, and vision insurance |

| Medicare Advantage Plans | Comprehensive coverage, including medical, hospital, and prescription drug coverage, with additional benefits |

Anthem’s Approach to Improving Healthcare Quality and Access

Anthem is committed to improving healthcare quality and expanding access to care. The company has implemented various initiatives to achieve these goals, including:

Value-Based Care Models

Anthem has adopted value-based care models, which focus on providing high-quality, patient-centered care while reducing healthcare costs. These models incentivize healthcare providers to deliver high-quality care and improve patient outcomes, rather than simply providing more services.

Telehealth Services

Anthem offers telehealth services, which enable policyholders to access medical care remotely. This can be especially beneficial for people who live in rural areas or have mobility issues, as it provides them with easier access to healthcare services.

Community Outreach Programs

Anthem has implemented community outreach programs, which aim to improve healthcare access and quality in underserved communities. These programs provide education, resources, and support to help people navigate the healthcare system and access the care they need.

In conclusion, Anthem's medical insurance plans offer comprehensive coverage and flexibility, allowing policyholders to choose the level of coverage that best suits their needs and budget. The company's commitment to improving healthcare quality and expanding access to care is reflected in its various initiatives, including value-based care models, telehealth services, and community outreach programs. As a trusted provider of health insurance solutions, Anthem continues to play a vital role in shaping the US healthcare landscape.

What types of medical insurance plans does Anthem offer?

+Anthem offers a range of medical insurance plans, including individual and family plans, group health insurance plans, and Medicare Advantage plans.

How does Anthem’s value-based care model work?

+Anthem’s value-based care model focuses on providing high-quality, patient-centered care while reducing healthcare costs. It incentivizes healthcare providers to deliver high-quality care and improve patient outcomes, rather than simply providing more services.

What is telehealth, and how does it work?

+Telehealth is a service that enables policyholders to access medical care remotely. It allows people to consult with healthcare providers via phone, video, or messaging, reducing the need for in-person visits and improving access to care.