The state of Maryland has been at the forefront of ensuring that its workers are paid a fair wage, with regular updates to the minimum wage law. As of January 2022, the Maryland minimum wage increased to $12.80 per hour for large employers, defined as those with 15 or more employees, and $12.20 per hour for small employers, defined as those with 14 or fewer employees. This update is part of a broader effort to raise the minimum wage to $15 per hour by 2025, with incremental increases each year.

Understanding the historical context of minimum wage laws in Maryland is crucial. The first federal minimum wage law was enacted in 1938, setting the wage at $0.25 per hour. Since then, there have been numerous increases, with Maryland often leading the way. In 2019, the Maryland General Assembly passed a law to gradually increase the minimum wage to $15 per hour by 2025. This move aims to keep pace with the rising cost of living and ensure that workers can afford basic necessities.

Key Points

- Maryland's minimum wage increased to $12.80 per hour for large employers and $12.20 per hour for small employers as of January 2022.

- The state aims to reach a $15 per hour minimum wage by 2025, with annual incremental increases.

- Employers with 14 or fewer employees are considered small employers and have a slightly lower minimum wage requirement.

- The minimum wage law applies to most employees in Maryland, except for certain exemptions such as agricultural workers and those under 20 years old working in a job deemed by the U.S. Department of Labor as an "opportunity wage" job.

- Employers must display a poster in the workplace outlining the minimum wage rates and other labor laws.

Impact of the Minimum Wage Increase

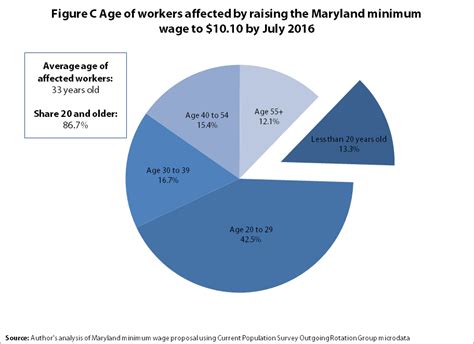

The increase in the minimum wage has significant implications for both employers and employees in Maryland. For employees, the higher wage rate means an increase in earnings, which can improve their standard of living. According to data from the Economic Policy Institute, a 15 minimum wage could benefit over 573,000 workers in Maryland, with the average affected worker seeing a wage increase of 3,200 per year. This can have a positive effect on the local economy, as workers are more likely to spend their increased earnings locally.

For employers, the increase in the minimum wage may require adjustments to their budget and operational strategies. Some may need to increase prices or reduce hiring to absorb the higher labor costs. However, studies have shown that moderate minimum wage increases can have negligible effects on employment rates, especially in industries with low profit margins and high employee turnover, where higher wages can lead to increased productivity and reduced recruitment costs.

Exemptions and Special Considerations

While the minimum wage law applies to most employees, there are certain exemptions and special considerations. For instance, workers under 20 years old may be paid $4.25 per hour for the first 90 consecutive calendar days of employment, known as the “youth minimum wage” or “training wage.” Additionally, employers of tipped employees, such as those in the food service or hospitality industries, may pay a lower minimum wage, provided that the employees receive enough tips to bring their total hourly earnings up to the standard minimum wage.

| Employer Size | Minimum Wage Rate |

|---|---|

| Large Employers (15+ employees) | $12.80 per hour |

| Small Employers (14 or fewer employees) | $12.20 per hour |

| Tipped Employees | $3.63 per hour (plus tips to reach minimum wage) |

| Workers Under 20 Years Old (first 90 days) | $4.25 per hour |

Future Increases and Considerations

Looking ahead, Maryland’s minimum wage is set to increase again in 2023 and subsequent years until it reaches $15 per hour in 2025. Employers should plan ahead for these changes, considering how they will manage the increased labor costs. This might involve reviewing pricing strategies, operational efficiencies, or even expanding benefits to attract and retain workers in a competitive labor market.

Furthermore, the discussion around minimum wage is closely tied to other labor laws and regulations, such as paid sick leave, family and medical leave, and workplace safety standards. Employers must stay informed about these developments to ensure compliance and maintain a positive, productive work environment.

What is the current minimum wage in Maryland for large employers?

+The current minimum wage in Maryland for large employers (those with 15 or more employees) is $12.80 per hour, as of January 2022.

Are there any exemptions to the minimum wage law in Maryland?

+Yes, there are exemptions, including for workers under 20 years old during their first 90 days of employment, and for tipped employees, who may be paid a lower minimum wage if they receive sufficient tips to reach the standard minimum wage.

How will the minimum wage increase affect employers in Maryland?

+The increase may require employers to adjust their budgets, potentially leading to higher prices for consumers or changes in hiring practices. However, it can also lead to increased productivity and reduced turnover among employees.