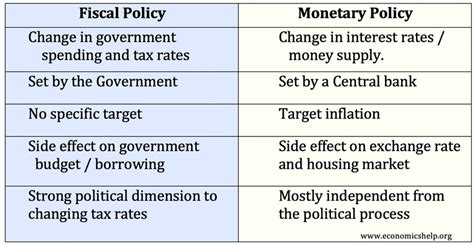

The distinction between monetary and fiscal policy is fundamental to understanding how governments and central banks manage their economies. Monetary policy and fiscal policy are two primary tools used to stabilize the economy, promote economic growth, and control inflation. While they share the same objectives, the approaches, mechanisms, and implications of these policies differ significantly.

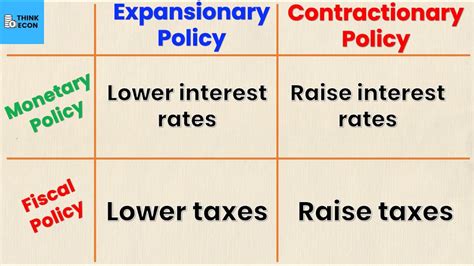

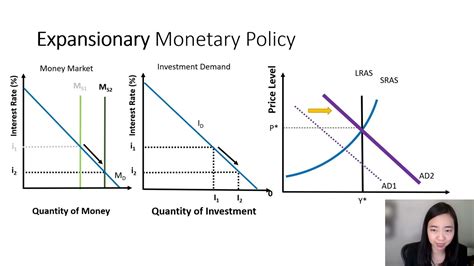

Monetary policy refers to the actions of a central bank, such as the Federal Reserve in the United States, aimed at controlling the money supply and interest rates to promote economic growth, stability, and low inflation. The central bank uses various tools, including setting interest rates, buying or selling government securities (open market operations), and adjusting reserve requirements for commercial banks, to influence the money supply and credit conditions in the economy. For instance, by lowering interest rates, the central bank can encourage borrowing, spending, and investment, thereby stimulating economic activity. Conversely, raising interest rates can help curb inflation by reducing borrowing and spending.

Monetary Policy Tools and Mechanisms

Central banks employ several monetary policy tools to achieve their objectives. One key tool is the setting of the discount rate, which is the interest rate at which the central bank lends money to commercial banks. Another crucial tool is open market operations, where the central bank buys or sells government securities to increase or decrease the money supply and influence interest rates. Additionally, central banks can adjust reserve requirements for commercial banks, which determines the proportion of deposits that banks must hold in reserve rather than lending out. These tools enable central banks to influence the money supply, interest rates, and credit conditions in the economy, thereby affecting aggregate demand and, consequently, economic activity and inflation.

Fiscal Policy Overview

Fiscal policy, on the other hand, refers to the use of government spending and taxation to influence the overall level of economic activity. It involves the government’s decisions on how much to spend, what to spend on, and how to finance that spending through taxation or borrowing. Fiscal policy can be expansionary, aiming to stimulate economic growth by increasing government spending or cutting taxes, or contractionary, seeking to reduce inflation or curb excessive demand by decreasing government spending or raising taxes. For example, during a recession, a government might implement an expansionary fiscal policy by increasing spending on infrastructure projects or reducing income taxes to boost aggregate demand and stimulate economic recovery.

| Economic Indicator | Monetary Policy Impact | Fiscal Policy Impact |

|---|---|---|

| Inflation Rate | Lowering interest rates can increase inflation; raising interest rates can reduce inflation | Expansionary fiscal policy can increase inflation; contractionary fiscal policy can reduce inflation |

| Economic Growth | Lower interest rates can stimulate growth; higher interest rates can slow growth | Expansionary fiscal policy can boost growth; contractionary fiscal policy can slow growth |

| Unemployment Rate | Monetary policy affects employment indirectly through its impact on economic growth | Fiscal policy can directly affect employment through government spending on job creation programs or indirectly through its impact on economic growth |

Key Points

- Monetary policy, controlled by central banks, focuses on regulating the money supply and interest rates to achieve economic stability and growth.

- Fiscal policy, determined by governments, involves the use of government spending and taxation to influence the level of economic activity.

- Both policies aim to stabilize the economy, promote growth, and control inflation but operate through different mechanisms and have different implications.

- The effectiveness of monetary and fiscal policies depends on their timing, coordination, and the specific economic conditions they are addressing.

- Understanding the distinction between monetary and fiscal policy is crucial for assessing the potential impacts of economic interventions and making informed decisions in both personal and professional contexts.

Coordination and Limitations of Monetary and Fiscal Policies

The coordination between monetary and fiscal policies is crucial for their effectiveness. Ideally, these policies should complement each other, especially during times of economic stress. However, there are challenges and limitations to consider. Monetary policy, for instance, can be constrained by the zero lower bound on interest rates, where cutting rates further becomes ineffective. Fiscal policy, while powerful, faces challenges related to the political process, the potential for crowding out private sector investment, and concerns over debt sustainability. The interaction between monetary and fiscal policies also raises questions about the distribution of power between the central bank and the government, as well as the potential for conflicting objectives.

Historical Context and Evolution

The evolution of monetary and fiscal policies has been shaped by historical events, economic theories, and the lessons learned from past successes and failures. The Great Depression and World War II led to a greater understanding of the role of government in stabilizing the economy, while the stagflation of the 1970s highlighted the limitations of monetary policy in controlling inflation. The Global Financial Crisis of 2008 underscored the importance of coordination between monetary and fiscal policies and the need for unconventional monetary policy tools. Today, policymakers continue to grapple with the challenges of a rapidly changing global economy, technological advancements, and shifting societal priorities, necessitating a continuous reevaluation of monetary and fiscal policy strategies.

In conclusion, monetary and fiscal policies are powerful tools that governments and central banks use to manage the economy. Understanding the mechanisms, implications, and limitations of these policies is essential for policymakers, economists, and the general public. As economic conditions evolve, so too must our approaches to monetary and fiscal policy, requiring a deep understanding of their interplay and the nuanced considerations that underpin their effective implementation.

What is the primary difference between monetary and fiscal policy?

+The primary difference lies in their mechanisms and control. Monetary policy is controlled by the central bank and focuses on the money supply and interest rates, while fiscal policy is determined by the government and involves government spending and taxation.

How do monetary and fiscal policies affect inflation?

+Both policies can influence inflation. Monetary policy can reduce inflation by raising interest rates, which decreases borrowing and spending. Fiscal policy can also impact inflation through its effects on aggregate demand; expansionary fiscal policy can increase inflation, while contractionary fiscal policy can reduce it.

What are some limitations of monetary policy?

+Monetary policy faces several limitations, including the zero lower bound on interest rates, potential ineffectiveness in situations of low inflation or deflation, and the risk of asset bubbles when interest rates are kept low for an extended period.