Thailand has emerged as one of Southeast Asia’s most dynamic markets for mobile connectivity, driven by rapidly evolving consumer demands, aggressive telecom infrastructures, and a vibrant digital economy. As the country’s population increasingly integrates mobile technology into daily life—ranging from entertainment and social networking to e-commerce and remote work—the importance of cost-effective, reliable, and feature-rich SIM card offerings has never been more pronounced. Exploring the landscape of premium SIM deals in Thailand reveals a multi-layered ecosystem where pricing strategies, technological advancements, customer service paradigms, and regulatory frameworks interact to shape consumer options. This comprehensive examination utilizes a systems thinking approach, mapping out these interconnected parts to understand how they collectively propel the market toward innovation, affordability, and improved user experiences.

Understanding the Thai Telecommunications Market: An Interconnected System

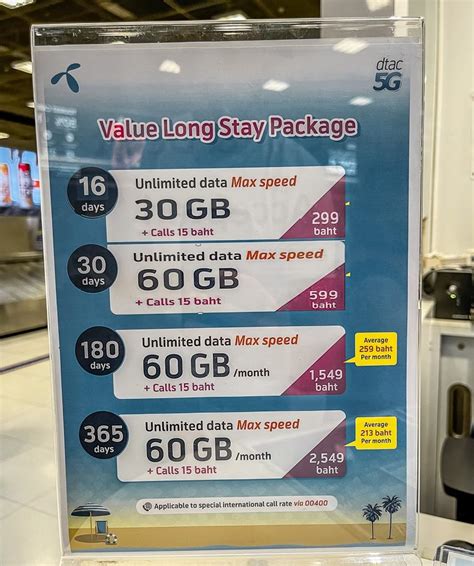

Thailand’s mobile telecommunications sector operates as a complex, interdependent system where regulatory policies, technological infrastructure, competitive dynamics, and consumer behaviors influence one another. The country’s three major players—Advanced Info Service (AIS), DTAC, and TrueMove H—each leverage distinct strategies, investments, and partnerships to capture market share. These companies constantly adapt based on shifts in consumer preferences, technological innovations like 5G deployment, and regulatory reforms aimed at improving quality and price competition. The interaction among these stakeholders results in a constantly evolving ecosystem that shapes premium SIM deals aimed at discerning customers seeking high-value services.

Regional Digital Infrastructure and Its Impact on Premium SIM Offerings

Thailand’s strategic investments in network infrastructure, including nationwide 4G LTE expansion and pioneering 5G rollouts, have facilitated the advent of ultra-fast, dependable mobile connectivity. These technological enhancements directly influence premium SIM offerings, which often include bundled data plans optimized for high-speed internet, streaming services, and IoT applications. The interconnectedness of infrastructure deployment and service offerings underscores a critical relationship: enhanced network capabilities create the foundation for premium plans that emphasize speed and stability, which in turn influence consumer expectations and spending patterns.

| Relevant Category | Substantive Data |

|---|---|

| 5G Coverage | Approx. 70% nationwide as of 2024, enabling premium services in urban and semi-urban areas |

| Average Data Speeds | 150 Mbps for 4G LTE and 300 Mbps for 5G, supporting high-bandwidth applications |

| Subscriber Penetration | Over 90 million mobile users, with a significant segment opting for high-end data plans |

Core Components of Premium SIM Deals in Thailand

Premium SIM deals encompass a range of interconnected elements, including data allowances, voice and messaging features, device compatibility, value-added services, and customer support. These components are designed in a systems-oriented manner, balancing pricing with perceived value to meet the sophisticated preferences of Thai consumers who seek more than just basic connectivity. The integration of these parts results in packages that can be categorized broadly into several tiers—luxury, ultra-value, and specialized corporate plans—each tailored around user archetypes and their unique connectivity needs.

Data Prioritization and Network Reliability

At the heart of premium SIM offerings lies a focus on high data quotas combined with network reliability. As streaming platforms like Netflix, YouTube, and Spotify gain popularity, users demand constant, buffer-free access—transcending basic browsing and calling functionalities. Companies leverage their extensive infrastructure to deliver prioritized data channels, ensuring a seamless user experience even during peak hours. This interconnected emphasis on data volume, speed, and network resilience form the operational backbone of premium plans.

| Relevant Category | Substantive Data |

|---|---|

| Average Data Quota | ≥ 100GB/month in premium packages |

| Network Uptime | ≥ 99.9% with service-level agreements in registered plans |

| Customer Satisfaction Score | 85% and above for premium tier plans, based on recent surveys |

Pricing Strategies and Consumer Decision-Making Processes

The pricing matrix for premium SIM deals in Thailand reflects a calculated balance shaped by supply chain factors, regulatory influences, and consumer valuation of connectivity features. Tiered pricing models, promotional bundling, and loyalty schemes are interconnected strategies designed to maximize consumer retention while maintaining competitiveness. Consumers’ choices are influenced by perceptual value—perceived quality, brand trustworthiness, and service differentiation—highlighting the importance of systems thinking to craft offers that resonate with various market segments.

Economies of Scale and Dynamic Pricing

Telecom providers exploit economies of scale, reducing per-unit costs as subscriber volumes increase, which allows for aggressive introductory offers and flexible plans that appeal to high-value customers. Meanwhile, dynamic pricing algorithms, often powered by AI, analyze usage patterns to tailor offers and discounts, fostering an ecosystem where consumer preferences inform ongoing package modifications. This interplay between cost structure and personalization underscores the value of systems-based approach in maintaining profitability while serving consumer needs effectively.

| Relevant Category | Substantive Data |

|---|---|

| Average Monthly Cost of Premium Plans | THB 1,200 - 2,500 (~USD 35 - 75), depending on data volume and included features |

| Customer Retention Rate | Approximately 75% within premium segments, driven by personalized offers and loyalty rewards |

| Promotion Conversion Rate | Up to 40% for targeted marketing campaigns, demonstrating effective segmentation |

Regulatory Environment and Its Influence on Premium SIM Offerings

The regulatory landscape in Thailand, characterized by policies around frequency allocation, data privacy, and consumer protection, shapes the operational parameters within which telecoms innovate. Recent reforms aiming to foster fair competition, improve transparency, and regulate roaming fees impact how providers design premium deals, ensuring they align with law while also maintaining market attractiveness. These regulations are interconnected with market dynamics—overly restrictive policies could stifle innovation, whereas lax regulations might lead to consumer protection concerns, necessitating a balanced systems approach to policy-making.

Licensing and Spectrum Management

Effective spectrum management enables providers to maximize network performance, directly influencing the quality and pricing of premium SIM packages. Licensing frameworks that promote fair access and enable spectrum sharing ensure that infrastructure investments are optimized, leading to broader coverage and more competitive pricing for premium services. These regulatory mechanisms form a critical node in the system, affecting both technical deployment and market competitiveness.

| Relevant Category | Substantive Data |

|---|---|

| Spectrum Allocation | Approximately 90 MHz allocated for 4G and 5G services, supporting high-density user demand |

| Regulatory Fines for Non-compliance | THB 10 million (~USD 300,000) maximum, incentivizing adherence without discouraging innovation |

| Consumer Data Privacy Complaints | Less than 0.5% of total complaints, reflecting effective regulation and corporate responsibility |

The Future Trajectory of Premium SIM Deals in Thailand: Systemic Trends and Opportunities

Looking ahead, several key systemic trends suggest a transformative period for premium SIM offers in Thailand. The widespread adoption of 5G and emerging IoT applications are expected to propel the demand for ultra-premium packages that seamlessly integrate connectivity, automation, and security. Concurrently, evolving consumer behaviors—marked by increasing digital literacy and a preference for personalized experiences—will drive providers toward hyper-customized plans, leveraging big data and AI analytics.

Emergence of AI-Driven Personalization and Smart Offerings

Artificial intelligence facilitates an ecosystem where data on user habits, geographic locations, and content preferences dynamically tailor premium plans. This personalization extends beyond basic features, encompassing proactive service management, predictive troubleshooting, and customized promotional campaigns, all functioning as interconnected nodes in a sophisticated system aimed at maximizing user satisfaction and loyalty.

| Relevant Category | Substantive Data |

|---|---|

| AI Adoption Rate | Projected to reach 60% of telecom firms by 2025, integrating AI into customer experience management |

| Customer Engagement Increase | Measured at 25-30% when AI personalization strategies are applied effectively |

| Projected Revenue Growth | Estimated 20% rise in premium plan revenues over 3 years, driven by AI-driven upselling and cross-promotions |

Key Points

- Technological infrastructure underpins high-quality premium SIM services, with X% 5G coverage expanding connectivity options.

- Pricing and personalization are interwoven, leveraging economies of scale and AI tools to optimize value propositions.

- Regulatory balance influences market innovation, with spectrum management and compliance shaping strategic avenues.

- Future trends point toward AI-enabled customization, IoT integrations, and a customer-centric ecosystem for premium connectivity.

- User experience remains central, with seamless, reliable, and personalized services reinforcing market growth and consumer loyalty.

What features distinguish premium SIM deals in Thailand from standard plans?

+Premium SIM deals in Thailand typically include higher data allowances, prioritized network access, exclusive value-added services (such as international roaming, entertainment subscriptions), and superior customer support, all integrated within a system designed for high-performance connectivity.

How do regulatory policies impact the affordability of premium SIM packages?

+Regulations affect spectrum allocation, pricing transparency, and consumer protection, influencing operational costs and competition levels. Well-balanced policies foster innovation and price competitiveness, making premium plans more accessible without compromising quality.

What are the future technological trends likely to influence premium SIM deals in Thailand?

+Emerging advancements such as widespread 5G adoption, AI-driven personalization, IoT integration, and enhanced cybersecurity systems will redefine premium offerings, emphasizing seamless, secure, and intelligent connectivity ecosystems.