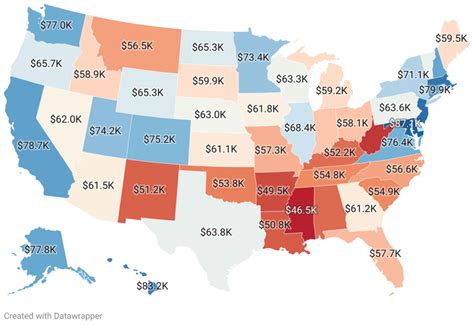

The state of New York, known for its vibrant cities, diverse economy, and high cost of living, presents a unique challenge when it comes to understanding salaries and their purchasing power. For individuals moving to New York or those already residing there, navigating the complexities of the state's tax system and how it impacts take-home pay is crucial. This guide aims to provide a comprehensive overview of the factors influencing salaries in New York, along with a practical salary calculator guide to help individuals estimate their net income.

Understanding New York’s Tax System

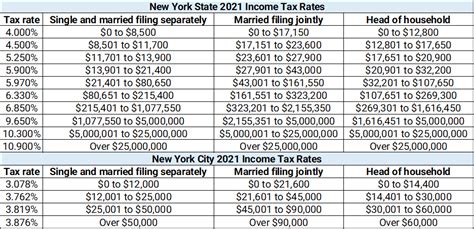

New York’s tax system is complex, with multiple layers of taxation that can significantly affect an individual’s net salary. The state has a progressive income tax system, with rates ranging from 4% to 8.82%, depending on the taxpayer’s filing status and income level. Additionally, New York City and Yonkers impose their own local income taxes, further reducing the take-home pay of individuals living in these areas. To accurately calculate one’s net income, it’s essential to consider these various tax rates and how they apply to different income brackets.

New York State Income Tax Rates

The New York State income tax rates for the tax year 2022 are as follows:

| Income Bracket | Tax Rate |

|---|---|

| $0 - $8,500 | 4% |

| $8,501 - $11,700 | 4.5% |

| $11,701 - $13,900 | 5.25% |

| $13,901 - $21,400 | 5.9% |

| $21,401 - $80,650 | 6.09% |

| $80,651 - $215,400 | 6.41% |

| $215,401 - $1,077,550 | 6.85% |

| $1,077,551 and over | 8.82% |

Using a New York Salary Calculator

A New York salary calculator can be a valuable tool for estimating your net income and understanding how different factors, such as tax rates and deductions, impact your take-home pay. These calculators typically require you to input your gross income, filing status, and other relevant information to provide an estimate of your net income.

Factors to Consider When Using a Salary Calculator

When using a New York salary calculator, there are several factors to consider to ensure an accurate estimate of your net income. These include:

- Gross Income: Your total income before taxes and deductions.

- Filing Status: Your marital status and the number of dependents you claim.

- Tax Rates: The state and local income tax rates that apply to your income level and location.

- Deductions: Any deductions you're eligible for, such as the standard deduction or itemized deductions.

- Exemptions: Any personal or dependent exemptions you're eligible for.

Key Points

- Understand New York's progressive income tax system and how it affects your net income.

- Consider both state and local taxes when estimating your take-home pay.

- Use a salary calculator to get an accurate estimate of your net income.

- Factor in deductions and exemptions to minimize your tax liability.

- Regularly review and adjust your tax strategy to ensure you're optimizing your net income.

Practical Applications of a Salary Calculator

A salary calculator can be a powerful tool for individuals looking to understand their net income and make informed financial decisions. By inputting different scenarios and adjusting variables such as income level, filing status, and deductions, you can gain a better understanding of how different factors impact your take-home pay.

Real-World Examples

For example, consider an individual who is moving from a state with no income tax to New York City. By using a salary calculator, they can estimate the impact of New York’s tax system on their net income and make informed decisions about their budget and financial planning. Similarly, an individual who is considering a job offer in New York can use a salary calculator to compare the net income of different job offers and make a more informed decision about which opportunity is best for them.

How do I calculate my net income in New York?

+To calculate your net income in New York, you'll need to consider both state and local taxes, as well as any deductions and exemptions you're eligible for. You can use a salary calculator to get an estimate of your net income based on your gross income, filing status, and other relevant factors.

What is the highest tax rate in New York?

+The highest tax rate in New York is 8.82%, which applies to income above $1,077,550 for single filers and $2,155,100 for joint filers.

How do I minimize my tax liability in New York?

+To minimize your tax liability in New York, consider taking advantage of deductions and exemptions, such as the standard deduction or itemized deductions. You can also consider consulting with a tax professional to ensure you're optimizing your tax strategy.

Meta Description: “Get a comprehensive guide to calculating your net income in New York, including a salary calculator and expert insights on navigating the state’s complex tax system.”

In conclusion, understanding the complexities of New York’s tax system and how it impacts your net income is crucial for making informed financial decisions. By using a salary calculator and considering factors such as tax rates, deductions, and exemptions, you can get an accurate estimate of your take-home pay and optimize your financial strategy. Whether you’re a resident of New York or considering a move to the state, this guide provides the expert insights and practical tools you need to navigate the state’s tax system with confidence.