Illinois, known for its vibrant cities, rich history, and world-class educational institutions, attracts students from all over the world. However, the rising cost of tuition can be a significant barrier for many aspiring students. Fortunately, there are several ways to make tuition more affordable in Illinois. In this article, we will explore five ways to reduce the financial burden of tuition in the state.

Key Points

- Illinois offers various financial aid programs to help students afford tuition

- Scholarships can provide significant funding for students who meet specific criteria

- Tuition waivers can help reduce or eliminate tuition costs for eligible students

- Income-driven repayment plans can make loan payments more manageable

- Community colleges and online courses can offer more affordable alternatives to traditional universities

Understanding Tuition Costs in Illinois

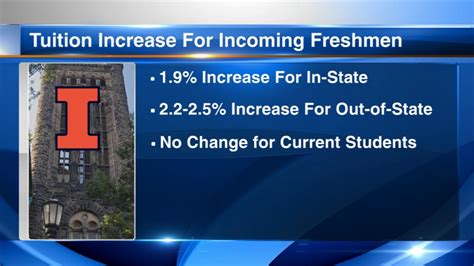

Tuition costs in Illinois vary depending on the institution and program. Public universities, such as the University of Illinois, tend to be more affordable than private institutions. However, even public universities can be expensive, with tuition ranging from 15,000 to 25,000 per year for in-state students. Out-of-state students can expect to pay significantly more, with tuition ranging from 25,000 to 40,000 per year.

Financial Aid Programs

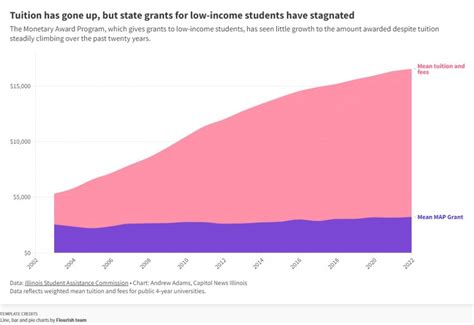

The state of Illinois offers several financial aid programs to help students afford tuition. The Monetary Award Program (MAP) provides need-based grants to eligible students. The Illinois Student Assistance Commission (ISAC) also offers various scholarships and grants to students who demonstrate financial need or academic achievement. For example, the Illinois National Guard (ING) Grant provides up to $5,000 per year to students who are members of the Illinois National Guard.

| Tuition Costs | In-State Students | Out-of-State Students |

|---|---|---|

| Public Universities | $15,000 - $25,000 | $25,000 - $40,000 |

| Private Universities | $30,000 - $50,000 | $40,000 - $60,000 |

Scholarships and Grants

Scholarships and grants can provide significant funding for students who meet specific criteria. The Illinois General Assembly Scholarship provides up to 5,000 per year to students who demonstrate academic achievement and financial need. The <em>Golden Apple Scholars of Illinois</em> program offers up to 23,000 per year to students who are pursuing a career in teaching. Additionally, many private organizations and foundations offer scholarships to students who meet specific criteria, such as the Illinois Rotary Scholarship, which provides up to $10,000 per year to students who demonstrate academic achievement and community service.

Tuition Waivers

Tuition waivers can help reduce or eliminate tuition costs for eligible students. The Illinois Veteran Grant (IVG) provides up to 100% tuition waiver for eligible veterans and their dependents. The Illinois National Guard (ING) Tuition Waiver also provides up to 100% tuition waiver for members of the Illinois National Guard. Additionally, some institutions offer tuition waivers for students who demonstrate financial need or academic achievement, such as the University of Illinois Tuition Waiver, which provides up to 50% tuition waiver for eligible students.

Income-Driven Repayment Plans

Income-driven repayment plans can make loan payments more manageable for students who have borrowed to finance their education. The Income-Based Repayment (IBR) plan caps monthly loan payments at 10% of discretionary income. The Pay As You Earn (PAYE) plan also caps monthly loan payments at 10% of discretionary income. Additionally, the Revised Pay As You Earn (REPAYE) plan provides more flexible repayment terms for students who have borrowed under the Direct Loan program.

Community Colleges and Online Courses

Community colleges and online courses can offer more affordable alternatives to traditional universities. The Illinois Community College Board offers various programs and courses at a lower cost than traditional universities. Online courses, such as those offered by Illinois Online, can also provide more flexibility and affordability for students who need to balance work and family responsibilities. For example, the Illinois Community College Online program offers over 1,000 online courses and degree programs at a lower cost than traditional universities.

What is the difference between a scholarship and a grant?

+A scholarship is a type of financial aid that is awarded to students based on merit or achievement, while a grant is a type of financial aid that is awarded to students based on financial need.

How do I apply for financial aid in Illinois?

+To apply for financial aid in Illinois, students must complete the Free Application for Federal Student Aid (FAFSA) and submit it to the Illinois Student Assistance Commission (ISAC).

What is the deadline for applying for financial aid in Illinois?

+The deadline for applying for financial aid in Illinois varies depending on the institution and program, but students are encouraged to apply as early as possible to ensure consideration for all available aid.

In conclusion, while tuition costs in Illinois can be a significant barrier for many students, there are several ways to make tuition more affordable. By exploring financial aid programs, scholarships, and grants, students can reduce their tuition costs and pursue their educational goals. Additionally, income-driven repayment plans and community colleges can provide more manageable and affordable alternatives to traditional universities.

Meta Description: Discover five ways to reduce tuition costs in Illinois, including financial aid programs, scholarships, and grants. Learn how to make tuition more affordable and pursue your educational goals in Illinois. (147 characters)