The 1099-MISC form is a crucial document used by the Internal Revenue Service (IRS) to report various types of income that are not subject to traditional employment taxes. This form is used to report miscellaneous income, such as freelance work, independent contracting, and other non-employee compensation. In this article, we will delve into five essential facts about the 1099-MISC form, providing you with a comprehensive understanding of its purpose, requirements, and implications.

Key Points

- The 1099-MISC form is used to report miscellaneous income, such as freelance work and independent contracting.

- The IRS requires payers to issue 1099-MISC forms to recipients by January 31st of each year.

- Recipients must report 1099-MISC income on their tax returns, using Schedule C to calculate net earnings from self-employment.

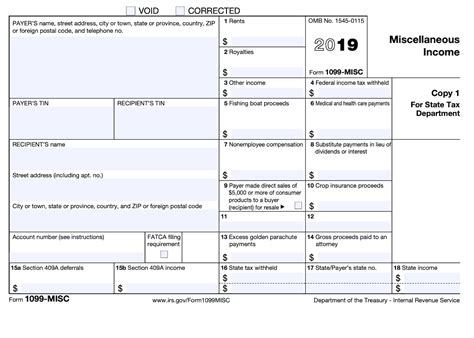

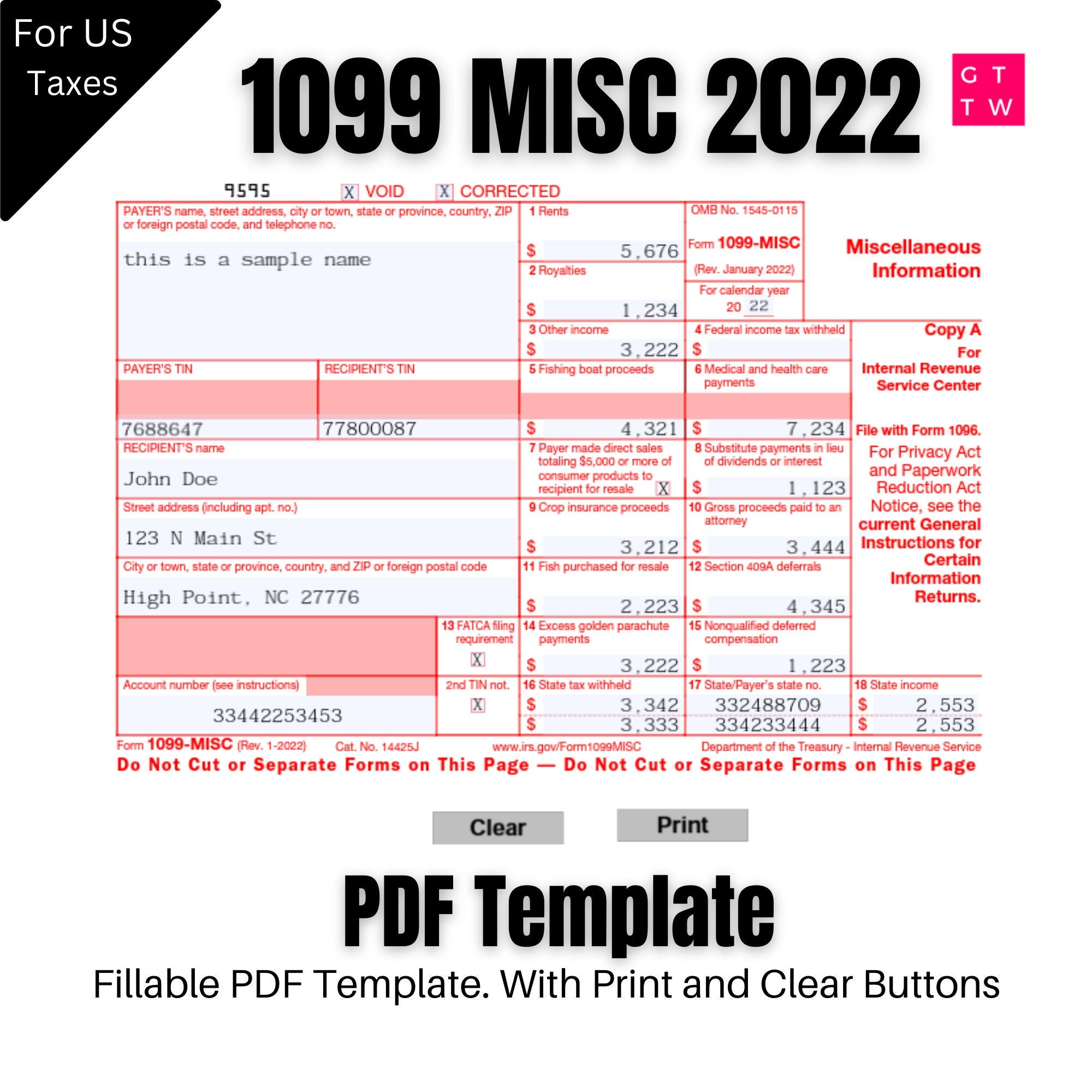

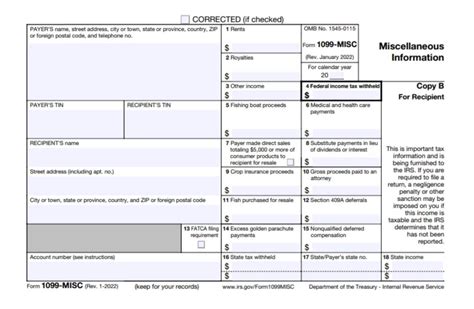

- The 1099-MISC form has various boxes, each representing a different type of income, such as rents, royalties, and non-employee compensation.

- The IRS imposes penalties on payers who fail to issue 1099-MISC forms or report incorrect information, emphasizing the importance of accuracy and compliance.

Fact 1: Purpose and Requirements

The primary purpose of the 1099-MISC form is to report miscellaneous income that is not subject to traditional employment taxes. This includes income earned from freelance work, independent contracting, and other non-employee compensation. The IRS requires payers to issue 1099-MISC forms to recipients who have earned at least $600 in miscellaneous income during the tax year. Payers must provide recipients with a copy of the 1099-MISC form by January 31st of each year, and file a copy with the IRS by February 28th (or March 31st if filing electronically).

Understanding the 1099-MISC Form Boxes

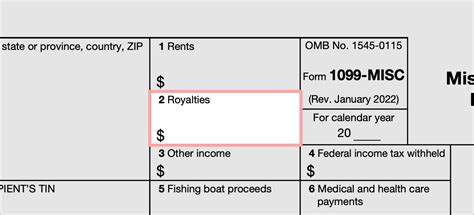

The 1099-MISC form has various boxes, each representing a different type of income. For example, Box 1 reports non-employee compensation, such as freelance work and independent contracting, while Box 2 reports royalties and Box 3 reports other income, such as prizes and awards. It is essential to understand the purpose of each box and accurately report the corresponding income to avoid errors and penalties.

Fact 2: Reporting 1099-MISC Income

Recipients of 1099-MISC forms must report the income on their tax returns, using Schedule C to calculate net earnings from self-employment. Schedule C is used to report business income and expenses, and recipients must complete this form to calculate their net earnings from self-employment. The net earnings from self-employment are then reported on the recipient’s tax return, and are subject to self-employment taxes.

Self-Employment Taxes and 1099-MISC Income

Self-employment taxes are used to fund Social Security and Medicare, and are calculated based on net earnings from self-employment. Recipients of 1099-MISC forms must pay self-employment taxes on their net earnings from self-employment, which includes income reported on the 1099-MISC form. It is essential to understand the self-employment tax rules and regulations to ensure accurate reporting and payment of self-employment taxes.

Fact 3: Penalties for Non-Compliance

The IRS imposes penalties on payers who fail to issue 1099-MISC forms or report incorrect information. The penalty for failing to issue a 1099-MISC form can range from 30 to 100 per form, depending on the timing of the failure. Additionally, payers who intentionally disregard the requirement to issue 1099-MISC forms can be subject to a penalty of $250 per form. It is essential to comply with the 1099-MISC form requirements to avoid these penalties and ensure accurate reporting of miscellaneous income.

Importance of Accurate Reporting

Accurate reporting of 1099-MISC income is crucial to avoid errors and penalties. Payers must ensure that they issue 1099-MISC forms to the correct recipients, and report the correct amount of income in the correct boxes. Recipients must also ensure that they accurately report 1099-MISC income on their tax returns, using Schedule C to calculate net earnings from self-employment. Accurate reporting of 1099-MISC income is essential to ensure compliance with IRS regulations and avoid penalties.

| 1099-MISC Form Boxes | Description |

|---|---|

| Box 1 | Non-employee compensation (e.g., freelance work, independent contracting) |

| Box 2 | Royalties |

| Box 3 | Other income (e.g., prizes, awards) |

| Box 4 | Federal income tax withheld |

| Box 5 | State tax withheld |

| Box 6 | State/Payer's state no. |

| Box 7 | State income |

Fact 4: 1099-MISC Form Changes

The 1099-MISC form has undergone changes in recent years, with the addition of new boxes and revisions to existing boxes. For example, the 2020 1099-MISC form includes a new box for reporting non-employee compensation, and revisions to the instructions for reporting royalties and other income. It is essential to stay up-to-date with the latest changes to the 1099-MISC form to ensure accurate reporting and compliance with IRS regulations.

Importance of Staying Up-to-Date

Staying up-to-date with the latest changes to the 1099-MISC form is crucial to ensure accurate reporting and compliance with IRS regulations. Payers and recipients must ensure that they are aware of the latest changes to the form, including new boxes and revisions to existing boxes. This can be achieved by regularly checking the IRS website for updates, and consulting with tax professionals to ensure compliance with the latest regulations.

Fact 5: 1099-MISC Form Filing Requirements

The 1099-MISC form filing requirements vary depending on the type of income being reported. For example, payers who report non-employee compensation must file the 1099-MISC form with the IRS by February 28th (or March 31st if filing electronically). Payers who report other types of income, such as royalties and other income, must file the 1099-MISC form with the IRS by February 28th (or March 31st if filing electronically). It is essential to understand the filing requirements for the 1099-MISC form to ensure compliance with IRS regulations.

Understanding the Filing Requirements

Understanding the filing requirements for the 1099-MISC form is crucial to ensure compliance with IRS regulations. Payers must ensure that they file the 1099-MISC form with the IRS by the required deadline, and recipients must ensure that they receive a copy of the 1099-MISC form by January 31st of each year. Failure to comply with the filing requirements can result in penalties and fines, emphasizing the importance of accurate reporting and compliance with IRS regulations.

What is the purpose of the 1099-MISC form?

+The 1099-MISC form is used to report miscellaneous income, such as freelance work, independent contracting, and other non-employee compensation.

Who is required to issue 1099-MISC forms?

+Payers who have paid at least $600 in miscellaneous income to a recipient during the tax year are required to issue a 1099-MISC form to the recipient.

What are the penalties for failing to issue a 1099-MISC form?

+The penalty for failing to issue a 1099-MISC form can range from $30 to $100 per form, depending on the timing of the failure. Additionally, payers who intentionally disregard the requirement to issue 1099-MISC forms can be subject to a penalty of $250 per form.

Meta Description: Learn about the 1099-MISC form, including its purpose, requirements, and implications. Understand how to report 1099-MISC income and avoid penalties for non-compliance.