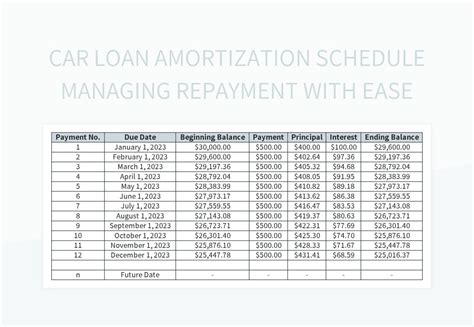

A car note, also known as a car loan or auto loan, is a type of financing that allows individuals to purchase a vehicle by borrowing money from a lender. The borrower agrees to repay the loan, plus interest, over a specified period of time, usually in monthly installments. This type of financing is commonly used by people who cannot afford to pay the full purchase price of a vehicle upfront.

Understanding Car Notes

When you take out a car note, you are essentially entering into a contract with the lender, where you promise to make regular payments, known as installments, until the loan is fully repaid. The loan is secured by the vehicle itself, meaning that if you fail to make payments, the lender can repossess the vehicle to recover their losses. The terms of the loan, including the interest rate, loan amount, and repayment period, are agreed upon by both parties before the loan is disbursed.

Key Components of a Car Note

A car note typically consists of several key components, including:

- Principal Amount: The initial amount borrowed to purchase the vehicle.

- Interest Rate: The percentage rate at which interest is charged on the loan, expressed as a decimal or percentage.

- Repayment Period: The length of time over which the loan is repaid, usually expressed in months or years.

- Monthly Payment: The amount paid each month to repay the loan, which includes both principal and interest.

| Loan Component | Description |

|---|---|

| Loan Amount | The total amount borrowed, including principal and interest. |

| Interest Rate | The rate at which interest is charged, typically expressed as a percentage. |

| Loan Term | The length of time over which the loan is repaid, usually expressed in months or years. |

Types of Car Notes

There are several types of car notes available, including:

- Simple Interest Loan: A loan where interest is calculated only on the outstanding principal balance.

- Precomputed Interest Loan: A loan where interest is calculated on the initial principal amount, regardless of the outstanding balance.

- Lease: A type of financing where you pay to use a vehicle for a specified period, with the option to purchase at the end of the lease.

Benefits and Drawbacks of Car Notes

Car notes can be beneficial for individuals who need a vehicle but cannot afford to pay cash upfront. However, they also come with some drawbacks, including:

- Interest Charges: The borrower must pay interest on the loan, which can increase the total cost of the vehicle.

- Repossession Risk: If the borrower fails to make payments, the lender can repossess the vehicle.

- Depreciation: The value of the vehicle may decrease over time, potentially leaving the borrower owing more on the loan than the vehicle is worth.

Key Points

- A car note is a type of financing that allows individuals to purchase a vehicle by borrowing money from a lender.

- The loan is secured by the vehicle itself, and the borrower must make regular payments to repay the loan.

- Car notes come with interest charges, which can increase the total cost of the vehicle.

- There are different types of car notes, including simple interest loans, precomputed interest loans, and leases.

- It's essential to carefully review the terms of a car note before signing, to ensure you understand the total cost of the loan and can afford the monthly payments.

In conclusion, a car note can be a useful financing option for individuals who need a vehicle but cannot afford to pay cash upfront. However, it's essential to carefully review the terms of the loan and understand the total cost of the loan, including interest charges, to ensure you can afford the monthly payments.

What is the difference between a car note and a lease?

+A car note is a type of financing where you borrow money to purchase a vehicle, whereas a lease is a type of financing where you pay to use a vehicle for a specified period, with the option to purchase at the end of the lease.

How do I determine the total cost of a car note?

+To determine the total cost of a car note, you need to calculate the total interest paid over the life of the loan, in addition to the principal amount borrowed. You can use a loan calculator or consult with a financial expert to help you determine the total cost of the loan.

What happens if I fail to make payments on my car note?

+If you fail to make payments on your car note, the lender can repossess the vehicle to recover their losses. This can also negatively impact your credit score, making it more difficult to obtain financing in the future.