The Federal Employer Identification Number (FEIN) is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to businesses and other entities for tax purposes. Understanding the FEIN is crucial for any business owner or organization, as it plays a significant role in the financial and legal operations of an entity. Here are five key facts about the FEIN that highlight its importance and application in the business world.

What is a FEIN and Its Purpose?

A FEIN, also known as an Employer Identification Number (EIN), is used to identify a business entity and is required for various purposes, including filing tax returns, opening bank accounts, and hiring employees. The IRS issues FEINs to businesses, non-profits, and other entities to track their tax obligations and ensure compliance with federal tax laws. Each FEIN is unique to the entity it is assigned to, ensuring that the IRS can accurately identify and monitor the financial activities of different businesses and organizations.

Obtaining a FEIN

To obtain a FEIN, an entity must apply through the IRS, either online, by phone, or by mail. The application process involves providing specific information about the business, such as its name, address, and type of business structure (e.g., sole proprietorship, partnership, corporation). Applicants must also identify the responsible party, who is the individual or entity that controls, manages, or directs the business and is responsible for its tax obligations. The IRS typically issues a FEIN immediately after receiving a complete application, allowing businesses to quickly proceed with their financial and operational setup.

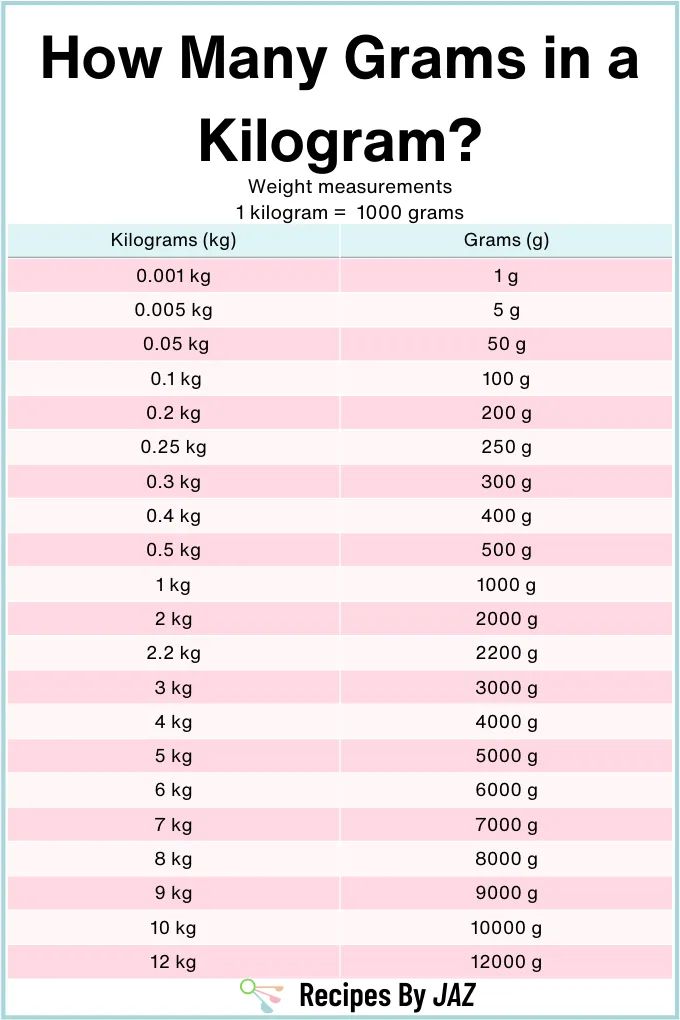

| FEIN Application Methods | Processing Time |

|---|---|

| Online Application | Immediate Issuance |

| Phone Application | Same-Day Issuance |

| Mail Application | 4 Weeks |

Usage and Importance of FEIN

A FEIN is essential for a variety of business operations, including but not limited to, filing employment tax returns, withholding taxes, and reporting income. Entities with employees must use their FEIN to report employment taxes and to file Form W-2, which details the wages paid to employees and the taxes withheld. Additionally, businesses use their FEIN to open business bank accounts, apply for credit, and establish lines of credit, highlighting the FEIN’s role in facilitating financial transactions and access to capital.

Security and Confidentiality

Given the sensitive nature of the information associated with a FEIN, it is crucial for businesses to maintain the confidentiality and security of their FEIN. This involves limiting access to authorized personnel and ensuring that all documents and communications containing the FEIN are handled and stored securely. Protecting the FEIN from unauthorized access is vital to prevent identity theft and other forms of financial fraud that could compromise the business’s financial integrity and reputation.

Key Points

- The FEIN is a unique nine-digit number assigned by the IRS to identify businesses and other entities for tax purposes.

- Obtaining a FEIN involves applying through the IRS with specific business information, including the identification of a responsible party.

- A FEIN is essential for filing tax returns, opening bank accounts, hiring employees, and conducting other financial operations.

- It is critical to maintain the confidentiality and security of the FEIN to prevent financial fraud and protect the business's financial integrity.

- Entities must use their FEIN for employment tax reporting, including filing Form W-2 and reporting income.

In conclusion, the Federal Employer Identification Number plays a vital role in the operational and financial management of businesses and other entities. Understanding the purpose, application, and security measures surrounding the FEIN is essential for compliance with tax laws, prevention of financial fraud, and the overall success of the business. By recognizing the importance of the FEIN and managing it appropriately, businesses can ensure they are well-positioned for financial stability and growth.

What is the purpose of a FEIN?

+The primary purpose of a FEIN is to identify a business entity for tax purposes, allowing the IRS to track its tax obligations and ensure compliance with federal tax laws.

How do I apply for a FEIN?

+You can apply for a FEIN through the IRS website, by phone, or by mail. The application process requires providing specific information about your business, including its name, address, and business structure.

Why is it important to keep my FEIN secure?

+Keeping your FEIN secure is crucial to prevent financial fraud and protect your business’s financial integrity. Unauthorized access to your FEIN could lead to identity theft and other forms of financial crime.