Worker compensation insurance, often referred to as workers' comp, is a vital aspect of the business world, offering crucial protection to both employers and employees. It's a legal requirement in many countries and plays a significant role in ensuring workplace safety and providing financial support to workers who suffer injuries or illnesses due to their jobs.

This comprehensive guide delves into the intricacies of worker compensation insurance, exploring its definition, historical evolution, legal implications, and practical applications. By understanding this essential coverage, employers can better navigate their legal and ethical responsibilities while employees gain insight into their rights and the benefits available to them.

Understanding Worker Compensation Insurance

Worker compensation insurance is a specialized form of insurance that protects employers from lawsuits and financial liabilities arising from workplace injuries or illnesses suffered by their employees. This insurance policy is a legal obligation in most jurisdictions and is designed to provide financial support to employees who sustain work-related injuries or illnesses, regardless of fault.

The primary objective of worker compensation insurance is to ensure that injured workers receive prompt and adequate medical treatment and financial compensation without having to engage in lengthy and potentially costly legal battles. This system is based on the principle of no-fault compensation, meaning that injured workers are entitled to benefits regardless of who was at fault for the injury or illness.

Historical Perspective

The concept of worker compensation insurance can be traced back to ancient times when various civilizations implemented systems to support injured workers. However, the modern worker compensation insurance system as we know it today has its roots in the early 20th century. The rapid industrialization and urbanization of that era led to an increase in workplace accidents and illnesses, prompting a need for a more structured and comprehensive approach to worker protection.

One of the key milestones in the development of worker compensation insurance was the establishment of the Workers' Compensation Act in the United Kingdom in 1897. This act, also known as the Employers' Liability Act, made it mandatory for employers to provide compensation to their workers who suffered injuries or illnesses in the course of their employment. This legislation served as a model for many other countries, including the United States, which began adopting similar laws in the early 1900s.

Over the years, worker compensation insurance has evolved to become a crucial component of labor law and workplace safety regulations worldwide. Today, it is a mandatory requirement for most employers, ensuring that workers have access to the necessary medical care and financial support when they suffer work-related injuries or illnesses.

Key Benefits of Worker Compensation Insurance

- Medical Coverage: Worker compensation insurance covers the cost of medical treatment for work-related injuries or illnesses. This includes doctor visits, hospital stays, surgeries, medications, and rehabilitative therapies. The insurance ensures that injured workers receive the necessary medical attention without delay.

- Income Replacement: Injured workers may be unable to work for an extended period, leading to a loss of income. Worker compensation insurance provides income replacement benefits, ensuring that workers receive a portion of their regular wages during their recovery period.

- Vocational Rehabilitation: In cases where an injury or illness prevents a worker from returning to their previous job, worker compensation insurance may cover the cost of vocational rehabilitation. This includes training and education to help the worker acquire new skills and find suitable alternative employment.

- Death Benefits: In the unfortunate event of a worker’s death due to a work-related injury or illness, worker compensation insurance provides death benefits to the worker’s surviving family members. These benefits can include burial expenses, as well as ongoing financial support for dependents.

Legal and Regulatory Framework

Worker compensation insurance operates within a complex legal and regulatory framework, with variations across different countries and even within states or provinces. Understanding these legal intricacies is crucial for employers to ensure compliance and for employees to know their rights.

Statutory Requirements

Most jurisdictions have enacted specific laws and regulations that mandate worker compensation insurance coverage for employers. These laws typically define the types of employers and employees covered, the scope of coverage, and the benefits that must be provided.

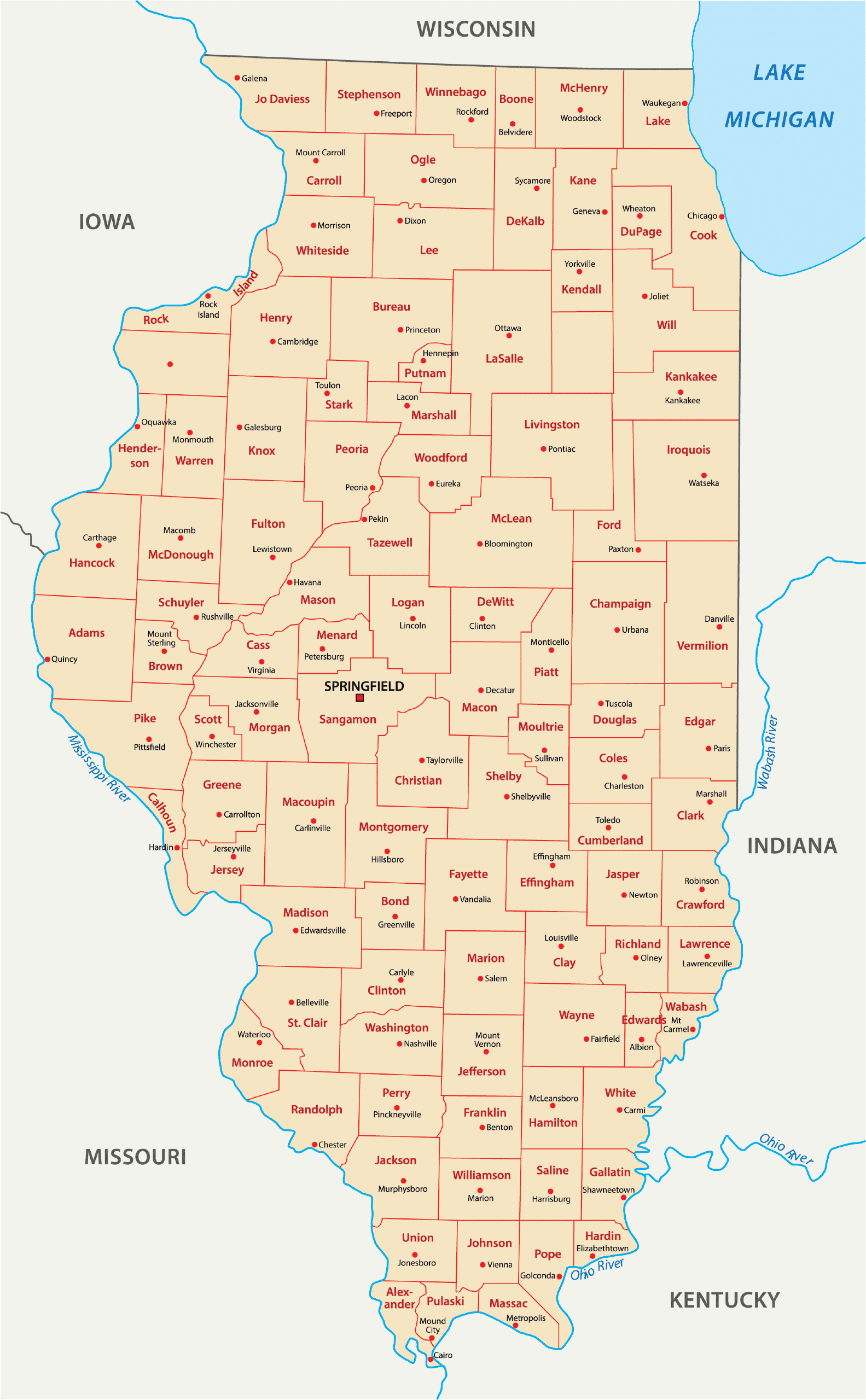

For example, in the United States, each state has its own worker compensation laws, which may differ significantly from one another. These laws often specify the minimum coverage requirements, the types of injuries and illnesses covered, and the benefits available to injured workers. Employers are typically required to carry worker compensation insurance from authorized insurers or, in some cases, through state-run funds.

Similarly, in other countries like the United Kingdom, Australia, and Canada, worker compensation insurance is governed by specific legislation at the national or provincial/state level. These laws outline the responsibilities of employers, the rights of workers, and the procedures for claiming and receiving benefits.

Enforcement and Penalties

Non-compliance with worker compensation insurance requirements can lead to severe penalties for employers. These penalties may include fines, lawsuits, and even criminal charges in cases of gross negligence or willful disregard for the law.

Enforcement of worker compensation insurance laws is typically handled by government agencies or departments dedicated to workplace safety and labor relations. These agencies conduct inspections, investigate complaints, and ensure that employers are providing the required coverage to their workers.

In the event of an accident or injury, injured workers or their representatives may file claims with the appropriate agency or insurer. The claims process involves submitting evidence of the injury or illness, proving that it occurred in the course of employment, and requesting the specific benefits owed under the applicable worker compensation law.

Claim Process and Benefits

The worker compensation insurance claim process is a critical aspect of this system, as it determines how and when injured workers receive the benefits they are entitled to. Understanding this process is essential for both employers and employees to ensure a smooth and efficient resolution.

Reporting an Injury or Illness

When a workplace injury or illness occurs, it is crucial to report it as soon as possible. In most jurisdictions, there are specific timeframes within which an injury or illness must be reported to the employer and the appropriate agency or insurer. Failure to report within these timeframes may result in the denial of benefits.

The reporting process typically involves completing and submitting an official claim form, which can be obtained from the employer, the insurer, or the relevant government agency. The form requires detailed information about the injury or illness, including the date, time, and circumstances of the incident, as well as any witnesses or supporting documentation.

Claim Investigation and Adjudication

Once a claim is reported, it undergoes a thorough investigation to determine its validity and the extent of the worker’s injuries or illnesses. This investigation may involve reviews of medical records, interviews with the worker and witnesses, and inspections of the workplace to identify potential hazards or contributing factors.

The insurer or government agency responsible for worker compensation insurance will assess the claim based on the evidence provided and the applicable laws and regulations. They will determine whether the injury or illness is covered under the worker compensation insurance policy and the specific benefits that the worker is entitled to receive.

Benefits and Entitlements

The benefits provided through worker compensation insurance can vary depending on the jurisdiction and the specific policy coverage. However, some common benefits include:

- Medical Benefits: Coverage for all necessary medical treatment related to the work injury or illness, including doctor visits, hospital stays, surgeries, medications, and rehabilitative therapies.

- Income Replacement Benefits: Compensation for lost wages during the recovery period, typically calculated as a percentage of the worker's regular wages. These benefits may be paid weekly, biweekly, or monthly.

- Permanent Disability Benefits: If the injury or illness results in a permanent disability, the worker may be entitled to ongoing financial support. The amount and duration of these benefits depend on the severity of the disability and the applicable laws.

- Vocational Rehabilitation Benefits: Coverage for the cost of training and education to help the worker acquire new skills and find suitable alternative employment if they cannot return to their previous job.

- Death Benefits: In the event of a worker's death due to a work-related injury or illness, the surviving family members may receive burial expenses and ongoing financial support, often calculated based on the worker's income and the number of dependents.

Best Practices for Employers and Employees

Navigating the world of worker compensation insurance requires a comprehensive understanding of the system and its intricacies. Both employers and employees have specific roles and responsibilities to ensure the smooth functioning of this system and the protection of workers’ rights.

Employer Responsibilities

- Compliance with Laws: Employers must ensure that they are in full compliance with the worker compensation insurance laws and regulations applicable to their jurisdiction. This includes obtaining the required insurance coverage, maintaining accurate records, and promptly reporting any workplace injuries or illnesses.

- Safety Measures: Employers should prioritize workplace safety by implementing appropriate safety measures, providing adequate training to employees, and regularly reviewing and updating safety protocols. A safe work environment reduces the risk of injuries and illnesses, which can lead to costly worker compensation claims.

- Claim Management: When a workplace injury or illness occurs, employers should take a proactive approach to claim management. This includes providing necessary support and resources to injured workers, assisting with the claim process, and ensuring that the worker receives the benefits they are entitled to in a timely manner.

Employee Rights and Responsibilities

- Reporting Injuries: Employees have a responsibility to report any workplace injuries or illnesses to their employer as soon as possible. Prompt reporting is crucial for ensuring timely access to medical treatment and initiating the worker compensation claim process.

- Understanding Rights: Employees should be well-informed about their rights and the benefits available to them under worker compensation insurance. This knowledge empowers them to advocate for their rights and ensure they receive the necessary support and compensation during their recovery.

- Cooperation: Injured workers should actively cooperate with the claim process, providing accurate and complete information to their employer, insurer, or the relevant government agency. This cooperation is essential for a swift and successful resolution of their claim.

Future Trends and Innovations

As with many areas of insurance and workplace safety, worker compensation insurance is continually evolving to adapt to changing circumstances and advancements in technology. Here are some key trends and innovations shaping the future of worker compensation insurance:

Technological Advancements

The integration of technology is revolutionizing various aspects of worker compensation insurance. Digital platforms and mobile apps are making it easier for employers and employees to report injuries, track claim progress, and access important information and resources.

For example, some insurers now offer digital claim management systems that streamline the entire process, from initial reporting to final resolution. These systems provide real-time updates, allow for the secure exchange of documents and information, and facilitate faster and more efficient claim processing.

Data Analytics and Risk Management

Advanced data analytics and risk management techniques are being employed to identify patterns and trends in workplace injuries and illnesses. By analyzing large datasets, insurers and employers can identify high-risk areas, develop targeted safety initiatives, and implement preventive measures to reduce the incidence of workplace injuries.

Additionally, data analytics can help insurers and employers assess the financial impact of worker compensation claims, identify cost-saving opportunities, and optimize their insurance coverage and risk management strategies.

Focus on Prevention and Rehabilitation

There is a growing emphasis on preventing workplace injuries and illnesses rather than simply reacting to them. Employers and insurers are investing in preventive measures, such as ergonomic improvements, safety training programs, and the implementation of best practices to create safer work environments.

Furthermore, there is a shift towards a more holistic approach to worker rehabilitation. This involves not only providing medical treatment but also offering support for mental health and well-being, as well as assisting workers in returning to work through tailored vocational rehabilitation programs.

Embracing Telehealth and Telemedicine

The rise of telehealth and telemedicine services is transforming the delivery of medical care to injured workers. These services offer convenient and efficient access to healthcare professionals, enabling timely assessments, treatments, and follow-ups without the need for in-person visits.

Telehealth and telemedicine not only improve access to care, especially in remote or rural areas, but also reduce the cost and inconvenience associated with traditional medical appointments. This can lead to faster recovery times and reduced healthcare costs for both employers and employees.

Conclusion

Worker compensation insurance is a critical component of workplace safety and employee protection. It ensures that injured workers receive the necessary medical care and financial support while providing employers with a legal and ethical framework to manage workplace injuries and illnesses.

As we've explored in this comprehensive guide, worker compensation insurance has a rich history, a complex legal landscape, and a vital role in ensuring the well-being of workers. By understanding the system, its benefits, and its future trends, employers and employees can work together to create safer and more supportive work environments.

The continuous evolution of worker compensation insurance, driven by technological advancements and a focus on prevention and rehabilitation, promises a brighter and more secure future for workers and employers alike. As we move forward, it is essential to stay informed and adapt to these changes to maximize the benefits of this essential insurance coverage.

What happens if an employer doesn’t have worker compensation insurance?

+If an employer fails to carry the required worker compensation insurance, they may face significant penalties, including fines, lawsuits, and even criminal charges in cases of gross negligence. Injured workers may also have the right to sue the employer directly for their injuries, bypassing the worker compensation system.

How long does it take to receive worker compensation benefits?

+The time it takes to receive worker compensation benefits can vary depending on the jurisdiction and the complexity of the claim. In general, the process should begin promptly after the injury is reported. For straightforward claims, benefits may be received within a few weeks. However, more complex cases can take several months or even longer to resolve.

Can worker compensation benefits be taxed?

+The tax treatment of worker compensation benefits varies depending on the jurisdiction and the specific circumstances. In some cases, worker compensation benefits may be considered tax-free, as they are intended to replace lost income due to a work-related injury or illness. However, in other cases, a portion of the benefits may be taxable. It is essential to consult with a tax professional or review the applicable tax laws to understand the tax implications in your specific situation.